What are the impacts of Yuan rise?

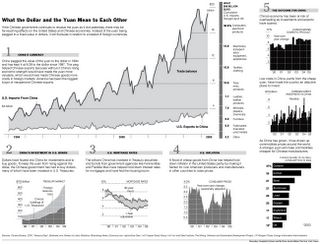

What the US $ and the Yuan mean to each other? Here the ASA provide you with the graph from the New York Times that help us to understand the impacts on the US economy.

At the same time, the revaluation of the Yuan will also affected different sectors. Here are the summary of the rise of Yuan:

Beneficiaries:

*Renminbi Savings holder

*Retails Importers in China

*Raw materials importers that the transaction through Renminbi

*Chinese traveler to consume in other countries

*Owned property in China

*Hold the Chinese Investment share

Sufferers

*Renminbi debtors

*Chinese Exporters

*Foreign Manufacturers who pay Renminbi to labour costs such as Wal-Mart

*Foreign tourist to consume in China

*Rent or lease property in China

*Need to remit to China

After the Chinese declared the depegged the Yuan with the US Dollar, the Malaysian Central Bank also echoed the same decision to depeg the Ringgit Malaysia that pegged with US $ since September 1998.

What are the impacts of this Yuan rise? Is there any political messages that Chinese government wants to deliver to the world? How about the Malaysian government move? Is there any relation with the China's move?

Hopefully someone from us especially those who are economist can help us to do some house clearing. Hope to hear from you all about this development.

<< Home